Demand for property in Bratislava rose by 30% in January. Although the supply has slightly decreased, there are more buyers in the market. The biggest revival has been in the secondary market, with demand for houses and the cheaper and mid-market apartments growing. Bratislava could see similar growth in demand and prices on the new-build market in four to six years, as in the 2017-2021 period. The period of market turbulence has also been changed by the approach of buyers, with much fewer "property tourists".

The property market has been picking up again. Buyers with a need to secure a property for their own use, who had been reluctant to buy because of the fall in prices and were waiting for prices to bottom out, are now back. Herrys estate agents reported a 30% increase in demand in January 2024 compared to the final quarter of last year. Although supply has not increased and may even have fallen slightly, there are more buyers in the market. As a result, properties that buyers found unattractive in 2023 have started selling. The biggest upturn has been seen in the secondary market, with demand growing for houses and cheaper and mid-range apartments between €150 000 and €350 000. The 35 – 55 age group is particularly keen to buy.

In January, Herrys continued to see an increase in the number of transactions completed, up by a quarter on the same period last year. In terms of new down payments made, it was the strongest month since December 2021.

The complicated period in the property market has changed the behaviour of buyers, who are more informed and have a better overview of their financing options.

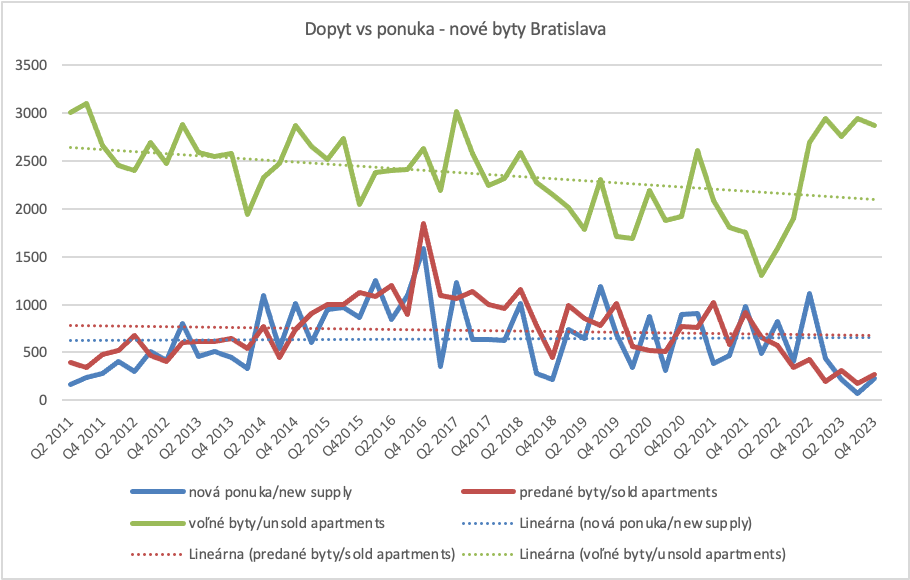

The situation in the new-build market last year was characterised by the lowest demand since 2008, which led to the postponement or freezing of several projects. As a result, housing prices did not fall; on the contrary, they rose on average compared to the previous year. 2023 can therefore be seen as a year of deferred consumption.

2024 can be seen as a year of opportunity. According to experts, secondary market prices have now bottomed out, bank interest rates are at their highest and there is the prospect of real wage growth.