• The growing trend in the number of sold apartments persists, despite a decrease in the number of sold apartments between quarters.

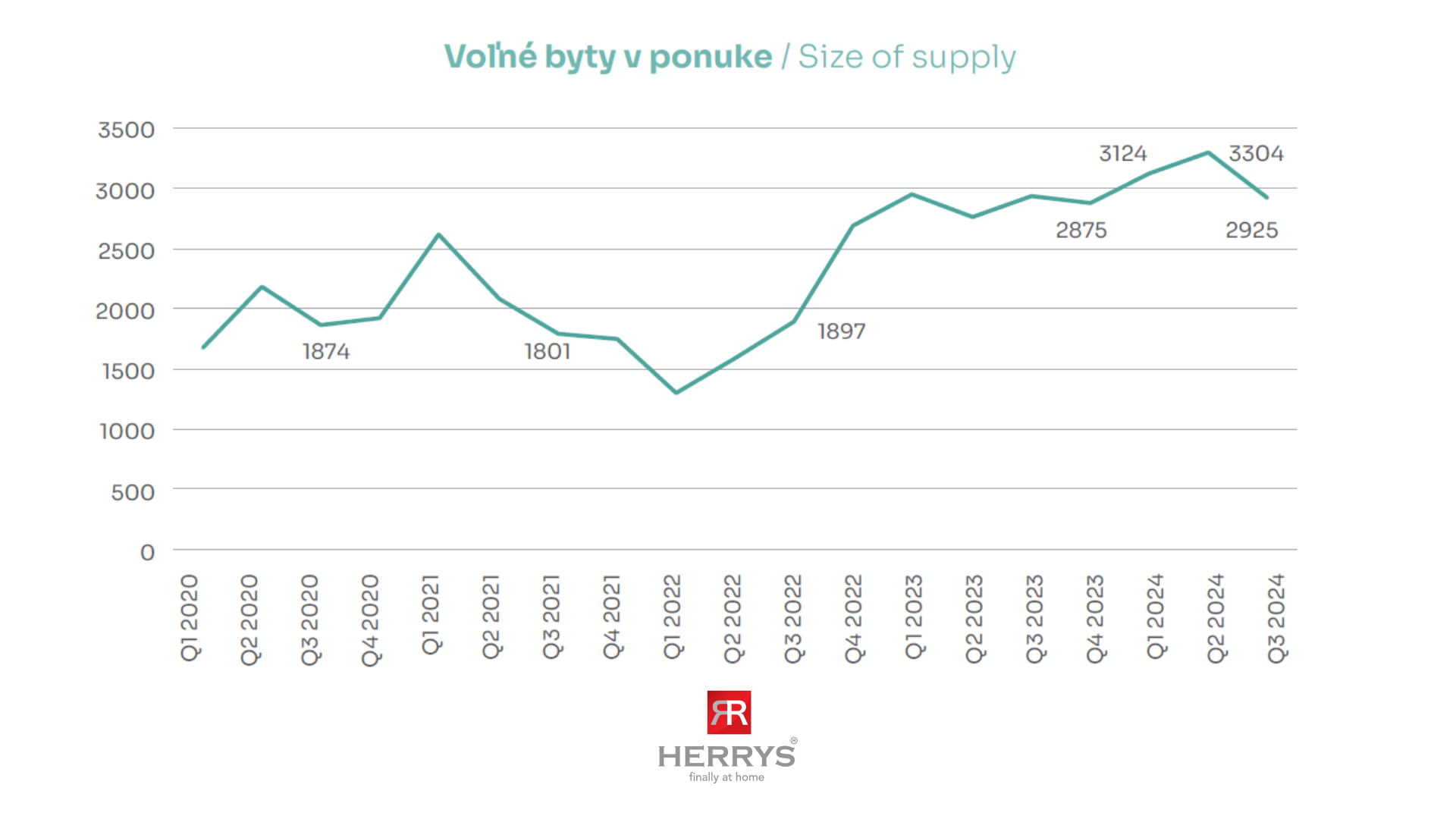

• The influx of new supply is at a historic low. The total supply has oscillated around 3,000 apartments over the last year.

• The return of investors to emerging projects and increased sales in completed projects are supporting the further growth of average prices.

• Market absorption is at the level of Q3 2022.

The Market Remains Stable, with New Projects Entering the Market

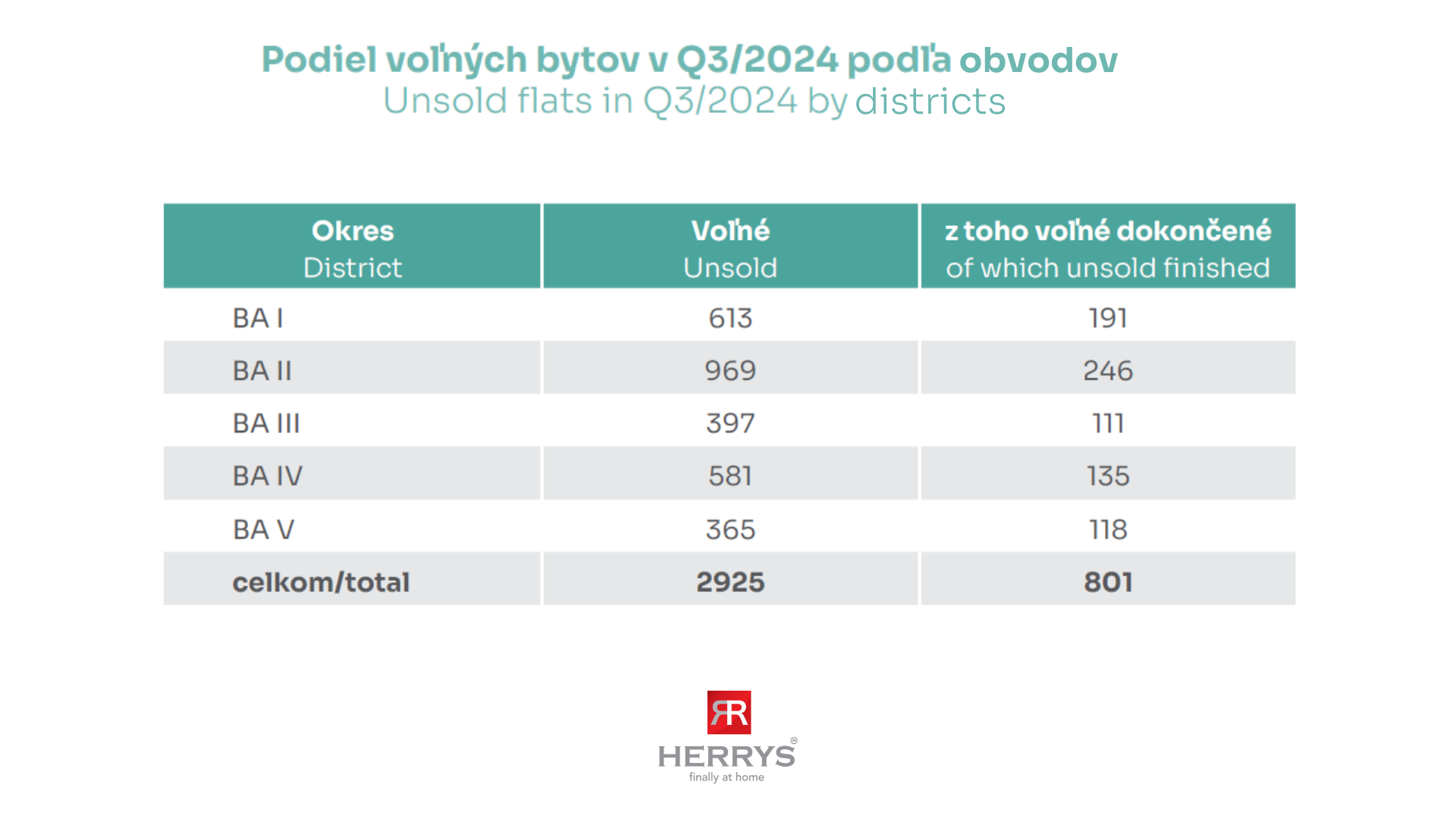

According to data from real estate agency Herrys, the total supply in Q3 2024 reached 2,925 new apartments, representing a quarterly decrease. However, the trend remains stable at around 3,000 apartments for almost two years. One-fifth of all projects account for 62% of the entire available supply. Two residential projects were added to the market, expanding the supply by nearly 100 new apartments. The distribution of apartment categories in the total supply has remained consistent, with 70% of the offered new apartments being two- and three-room units. The largest supply of larger apartments is concentrated in Bratislava V, while the highest number of smaller apartments (1- and 2+kk) is found in Bratislava I. The share of newly offered apartments in Bratislava I increased, while in Bratislava II, it decreased. The biggest decline in supply since the beginning of the year occurred in Bratislava III, where it dropped by 18%. The share of completed apartments in the market is gradually rising, currently representing 27%.

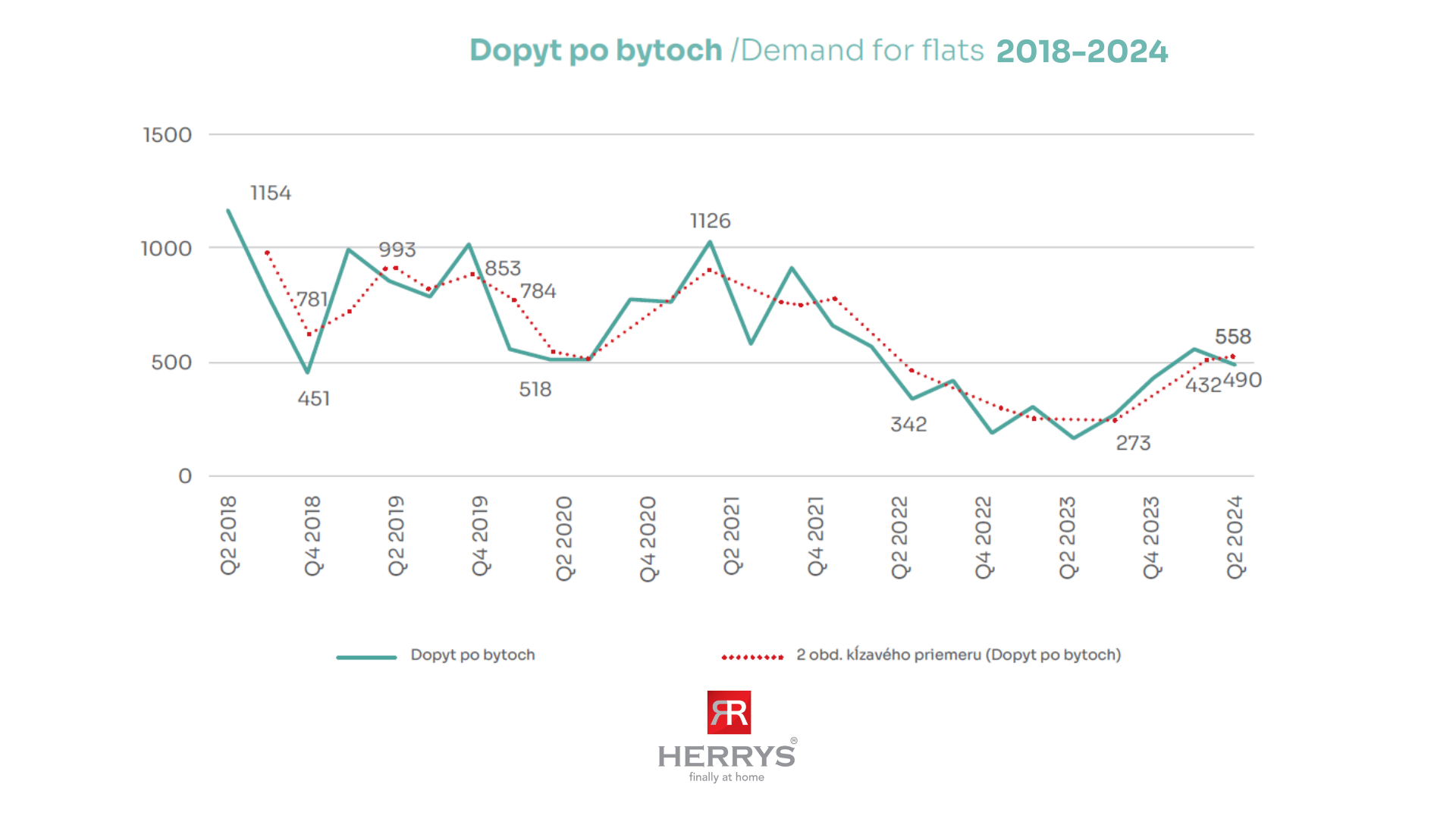

Demand in Bratislava Is Sharply Increasing, Led by Two- and Three-Room Apartments

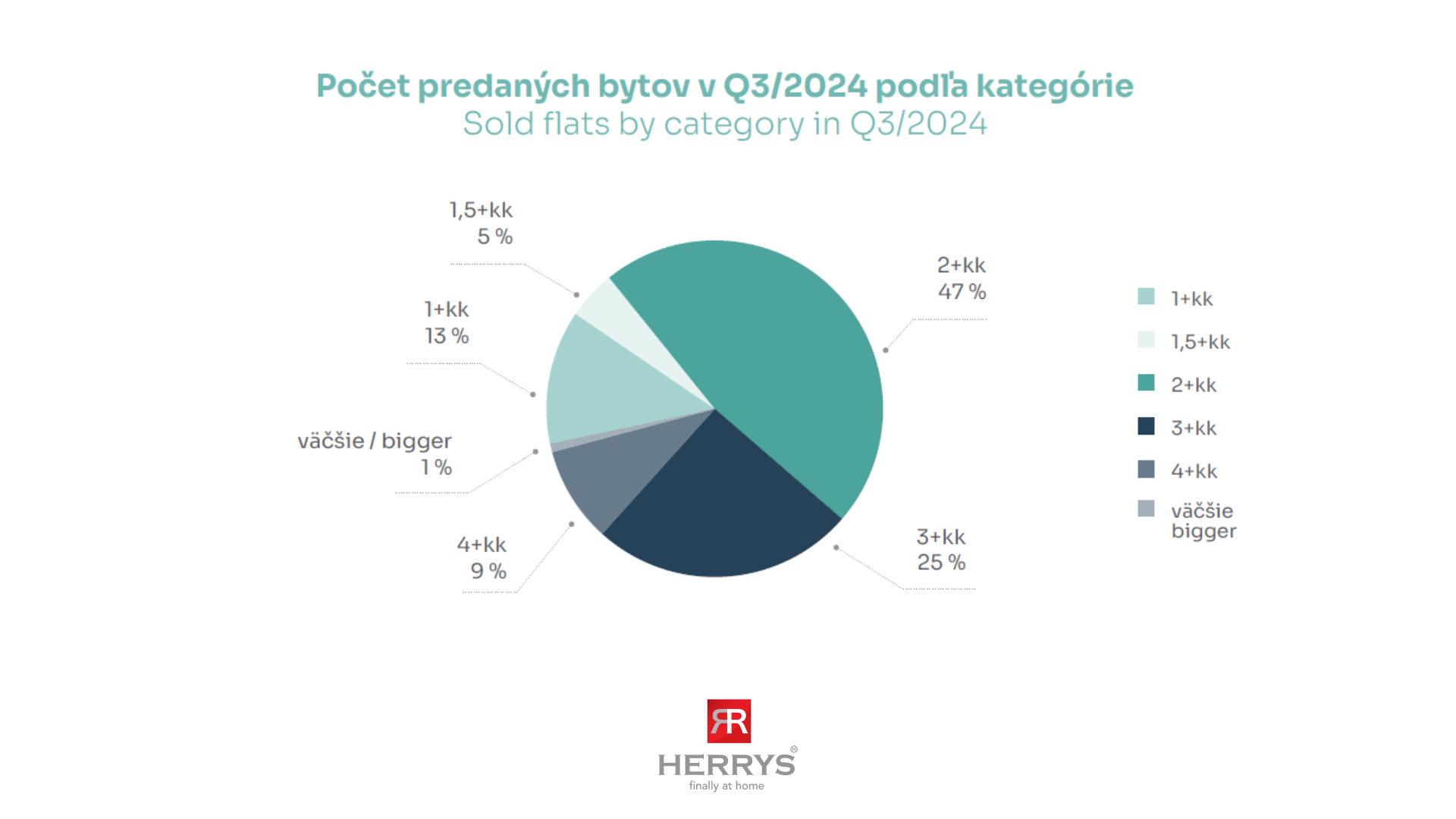

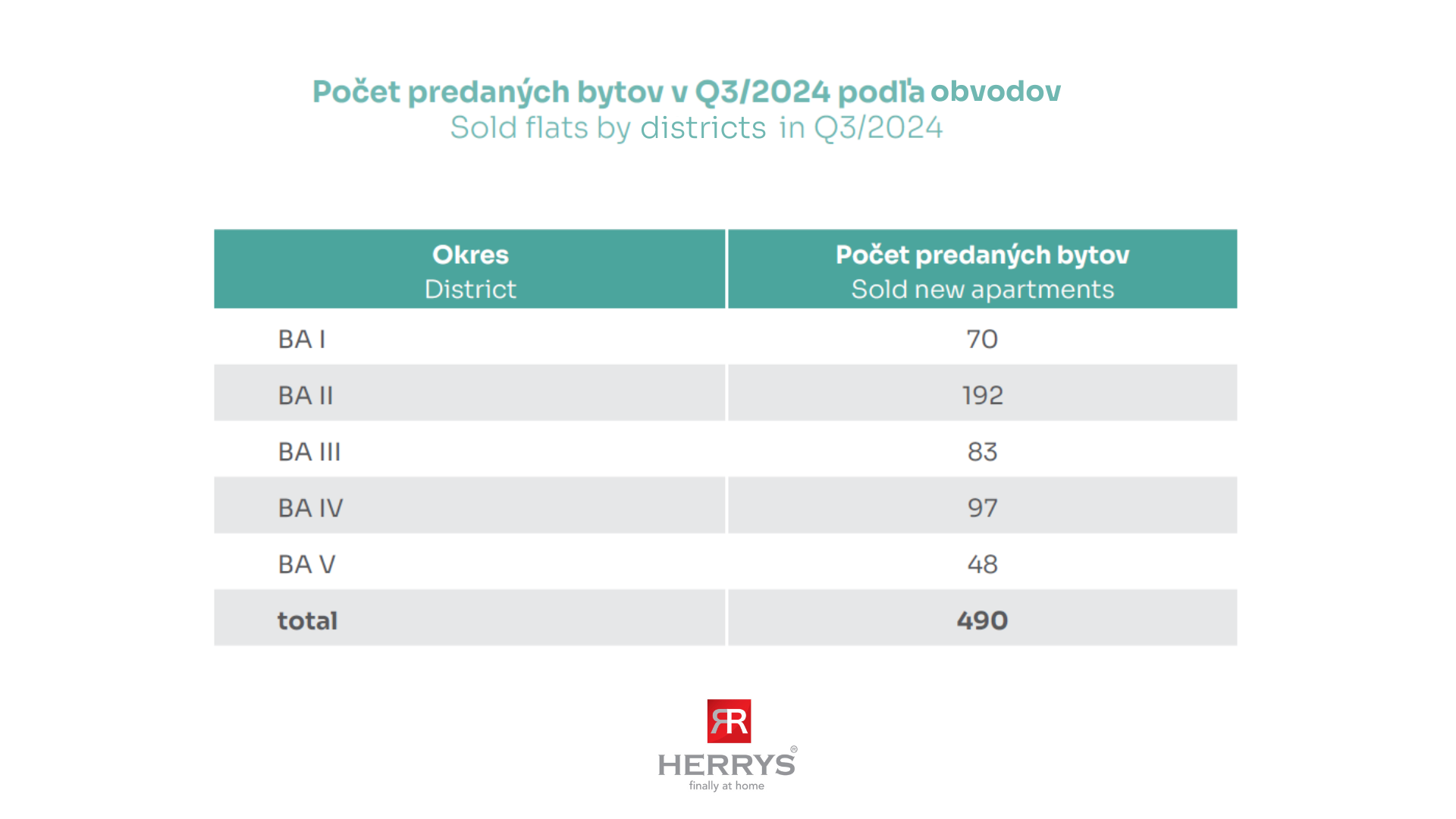

In Q3, 490 new apartments were sold in Bratislava. The sales pace, or the number of apartments sold per month, doubled year-on-year. Market absorption is gradually increasing and currently stands at 17%, though it is still only a third of the level seen in Q4 2021. The highest demand is still for two- and three-room apartments, although their share in sales has decreased by 5%, while sales of one- and four-room apartments increased by 6%. One-third of all sold apartments are in completed projects, marking a 70% year-on-year increase. The same number of apartments were sold in completed projects as in all projects combined last year. The most apartments are sold in the Bratislava II district, although the number of apartments sold in this district decreased in comparison to the previous quarter, while the share of sales in other parts of the city increased.

Price Growth Continues, with Bratislava I Leading the Market

The average price for new apartments in Q3 2024 reached €4,210 per m² (excluding VAT). Prices continue to rise at a slower pace, with a year-on-year increase of €250 per m² (excluding VAT). The most significant year-on-year price growth occurred in Bratislava II, where prices rose by 15.25%, reaching an average of €3,657 per m² (excluding VAT). The highest average price is in Bratislava I, where prices increased by 8.23% year-on-year, with an average price of €5,705 per m² (excluding VAT). Only 36% of the total supply is more expensive than the average price per square meter. The highest demand is for projects priced below the average, with 90% of apartments sold in these projects.

Expected Market Changes Due to the Increase in VAT

The higher tax burden expected in the upcoming year will affect demand already in Q4 2024.

The return of investor confidence is evident, as more than 40% of new projects have already sold out this year. Lower interest rates, combined with new projects in Q4 2024, will stimulate demand from both investors and buyers for personal housing. Buyers will increasingly focus on efficient floor plans due to the rising price per square meter. The increased tax burden will also affect construction costs, making price reductions unlikely.