The number of flats sold in new buildings in Bratislava and its surroundings doubled year-on-year. The offer, on the other hand, fell again in both year-on-year and quarterly comparisons. The same applies to the secondary market, where supply is lower by about 20% and offer prices increased by almost 15% year-on-year. The market is definitely the seller's market and there is no indication that this will change in the near future. This follows from the data of the real estate agency Herrys.

More flats will be sold on the Bratislava market of new buildings than will be added to the offer

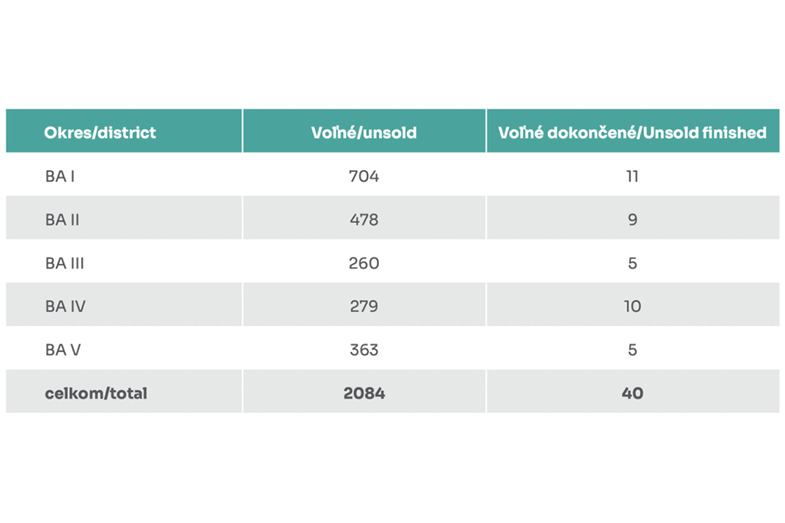

In the long run, the lowest offer of new flats is reported by BA III districts. and BA IV. Number of completed flats in new buildings does not even represent 2% of the total offer. The offer of new flats has been expanded by five new projects or by new stages of existing projects. The development trend of the total supply is declining. This means that more flats will be sold on the market than will be added to the offer.

The second quarter brought the most sold flats since 2019

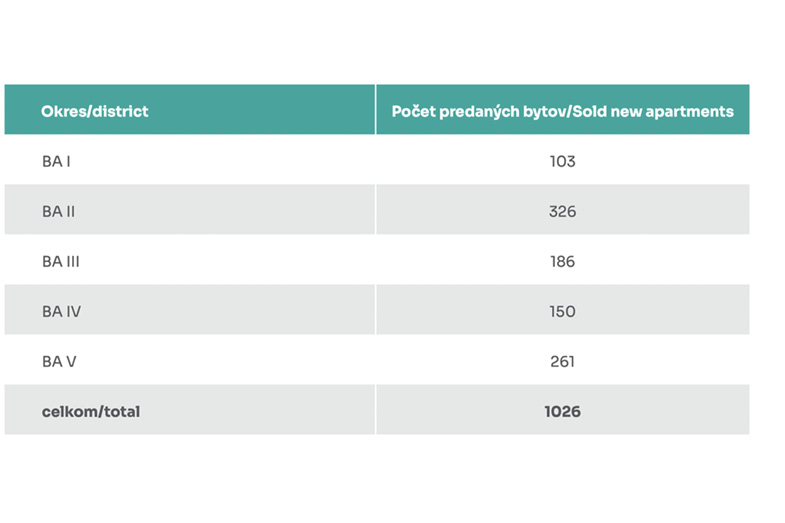

According to the Herrys office, a total of 1,026 flats in new projects were sold in the second quarter of 2021 in Bratislava. Historically, more than 1,000 flats sold in new projects were last recorded in 2018 and 2019, when the increase in flats sold was associated with an increase in new supply.

Most new flats were sold in the BA II district. The sale of more than 300 flats was recorded by a total of 21 projects, on average they sold at a rate of about five flats per month per project. The most successful projects sold more than 40 apartments per quarter. These were projects that started sales in Q2 or had a price tag below 3000 euros / m2 without VAT. In year-on-year comparison, almost 100% more flats were sold and compared to Q1 2021, 30% more flats were sold. "Currently, the offer in new buildings has decreased and it is possible to assume that the increased sales are mainly supported by fears of rising prices," said Filip Žoldák, RK Herrys.

Development of sales in Q2 on the secondary market

RK Herrys recorded the most sales on the secondary market in the localities BA I. and BA IV. The most popular were 2-room apartments - 41%, then one-room apartments 27% and 3-room apartments - 32%. According to Herrys' internal data, most clients in Q2 bought real estate on the secondary market for their own housing, with 58% and 42% buying clients for investment.

The rental market has reason for greater optimism

In the second quarter of 2021, RK Herrys concluded 30% more leases than they managed to conclude in the same period last year. Home rentals recorded lower interest compared to previous quarters. In terms of price, they recorded a small increase in RK Herrys compared to Q1, by less than 3% (the rental price in Q2 was 630 euros without energy, in Q1 it was 615 euros.

Of the localities, the rental was the best in the districts of BA I. - 33%, BA.II - 31% and BA.III - 24%. In terms of dispositions, the most requested apartments for rent were 2-room, up to 50%, followed by 3-room - 20% and 1-room - 16%. The average area of a rented apartment was 61 m2. Up to 44% of rented flats are located in new buildings younger than five years. The average age of the tenant was 33 years and the landlord 46 years (which is similar to previous quarters).